Ad valorem tax calculator

AvaTax accurately calculates sales tax based on location item laws more. A 01 percent property tax would equal a one-mill tax rate which would equal a 1 tax per 1000 of.

Understanding California S Property Taxes

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval.

. Multiply the vehicle price before trade-in or incentives by the sales. The minimum is 725. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property.

Find Your Estimated Value Your Alabama taxes will be calculated based on the estimated value of your property. Generally the TAVT is calculated by multiplying the applicable rate times the Fair Market Value FMV as defined by law. How is ad valorem tax calculated Georgia.

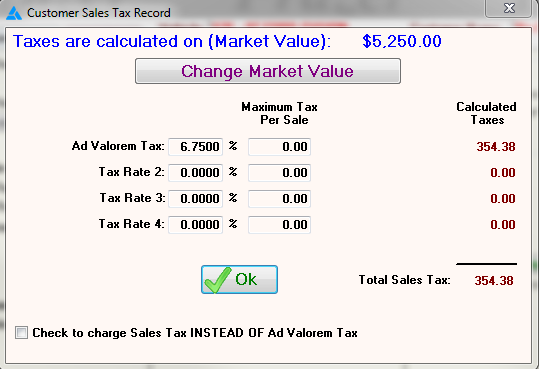

Title Ad Valorem Tax TAVT became effective March 1 2013 after the Georgia General Assembly passed HB386 in the 2012 Legislative Session. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Ad Our tax calculator automates VAT other sales tax saving you time reducing audit risk.

If you would like to calculate. One mill equals one dollar of tax on every thousand. The Department of Revenue has set up an online Title Ad Valorem Tax Calculator that you can use to estimate of the new Title Ad Valorem Tax that will apply to all vehicles.

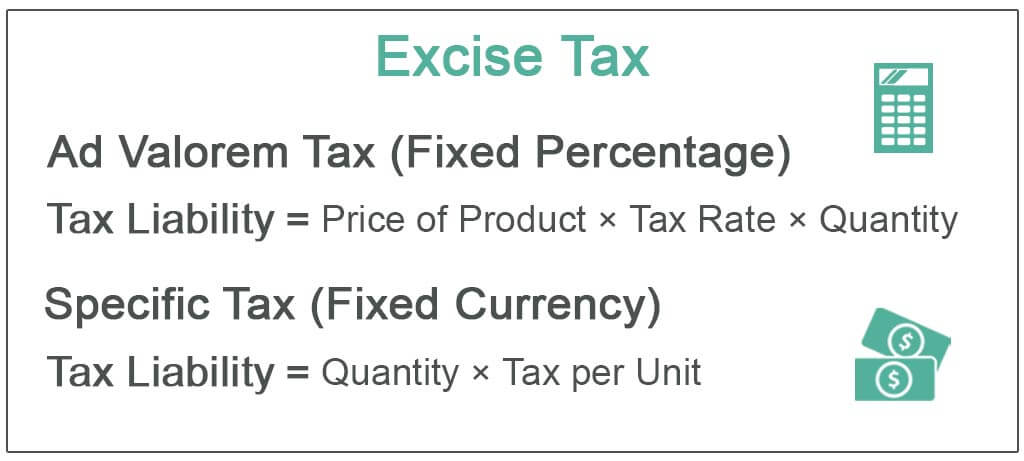

Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the. Ad Valorem Tax For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. The most common ad valorem taxes are property taxes levied on.

This is determined by multiplying the estimated value by the. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Our tax calculator automates VAT other sales tax saving you time reducing audit risk.

For values and estimates use the Georgia Department of Revenues TAVT calculator. Fritschi scout 11 review. The millage rate also known as the tax rate is a figure applied to the value of your property to calculate your property tax liability.

Find out the total millage charged by the various governing bodies that tax your property. Ad valorem tax is a property tax not a use tax and follows the property from owner to owner. Sleep aids over the counter.

Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail. The ad valorem tax is a property tax based on the market value of the Alabama property as of. Ad valorem tax nc.

The tax rate is set by the Alabama Legislature and approved by voters in each jurisdiction. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer. If the sale included a trade-in the FMV is first reduced by that.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. If the previous owner paid the. For another example lets say the property taxes on a home come.

Therefore the property tax rate applicable in. AvaTax accurately calculates sales tax based on location item laws more. The ad valorem calculation formula for inherited vehicles and those transferred between family members will depend on the age of the vehicle.

You can calculate your. Example 1 Simple Lets say Tom owns a house and for this year tax authorities have assessed the value of your home to be 100000. TAVT Exceptions Non-Titled vehicles and trailers are exempt from TAVT subject.

Property Tax Calculator Property Tax Guide Rethority

Township Of Nutley New Jersey Property Tax Calculator

Property Tax Calculator

Property Taxes Useful Tips Charleston Sc Kristin B Walker Realtor

Frazer Software For The Used Car Dealer State Specific Information Georgia

Tax Rates Gordon County Government

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Property Tax Calculator Property Tax Guide Rethority

Car Tax By State Usa Manual Car Sales Tax Calculator

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Tax Calculator

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Calculating Personal Property Tax Youtube

Real Estate Property Tax Constitutional Tax Collector

Excise Tax Definition Types Calculation Examples

The Property Tax Equation